While market volatility may seem frightening, it is an anticipated and natural part of market cycles. Timing of when market volatility will happen is very challenging. Currently, markets are adjusting after extraordinary growth in 2017 and into 2018 as a result of tax reform. There is also the anticipation of inflation, which is long over-due, along with rising interest rates that are typical when the economy is doing well.

What to Do During Market Volatility

Stay Calm

Rest assured that the domestic and global markets, which are comprised of thousands of businesses, remain strong. With a well-diversified portfolio that is uniquely situated for your specific long-term goals and objectives, you can take a deep breath and know you have a plan that factors in market volatility.

Historically, markets have recovered very well in times of turmoil. Downward turns in the markets have inevitably been followed by upward movement; thus, is the nature of markets!

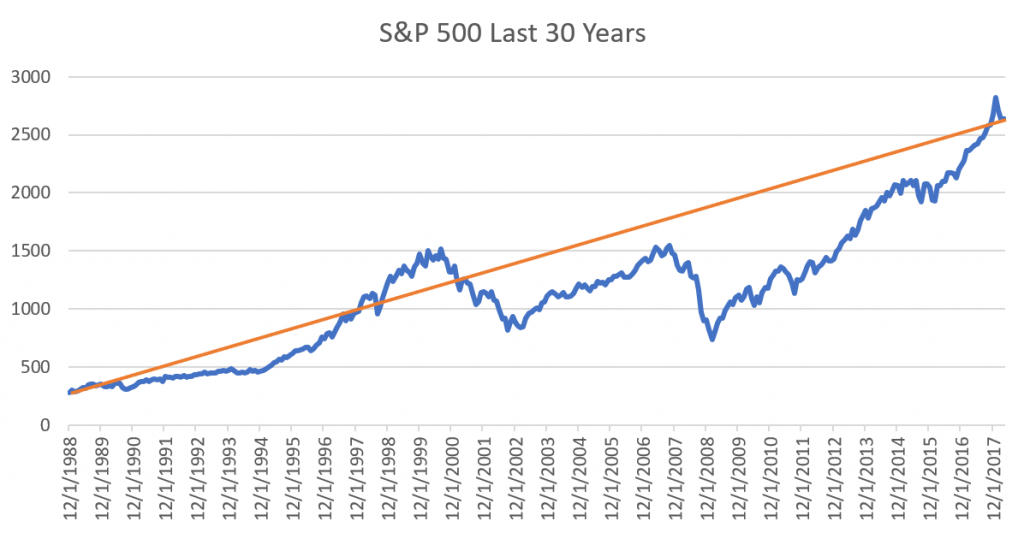

Take the example below for your reference:

*This chart reflects adjusted close price adjusted for both dividends and splits. Data is historical. Past performance is not a guarantee of future results.

The blue line represents the actual growth of the S&P 500 over the past 30 years. On April 1st 1988 the S&P closed at 261.33 and on April 1st 2018 the S&P closed at 2639.4. As you can see from the chart, there were some bumps along the way. However, if an investor came in on April 1st 1988, and stayed in the market through all of the turbulence, his investment would have grown by over 1000 percent.

Now look at the orange line. This line represents what many investors want and sometimes expect: no market turbulence and only upward movement. This is, of course, completely unrealistic. However, in both scenarios the result is the same. If an investor entered the market on April 1st 1988, went to another planet for 30 years and came back today, he would feel fantastic about the growth of his investment, having missed all the market turbulence. This example goes to show you should stay calm and invested through market movement.

Stay Invested

Although the markets will not look like the orange line in the example above, staying calm and staying invested is vital to maximize the performance of your investment. Timing the market correctly is very difficult since markets are unpredictable. Missing just a few good days can cost you thousands of dollars.

Look at the example below:

*Data is historical. Past performance is not a guarantee of future results.

Remember, investing is a long-term plan. While markets may move from day-to-day, you are in it for the long-haul. Market volatility may be an emotional experience. However, pulling out of the market at the first sign of volatility can cost you money and hurt your overall financial plan.

Don’t Make an Emotional Decision

Investors may struggle to separate their emotions from their investment decisions. When the market is high, investors may feel excited and invest at high prices. Once there is a downturn, fear can set in leading investors to offload their investment at a lower cost. This dangerous cycle of excessive optimism and fear leads to poor decisions at the worst time.

Investors may struggle to separate their emotions from their investment decisions. When the market is high, investors may feel excited and invest at high prices. Once there is a downturn, fear can set in leading investors to offload their investment at a lower cost. This dangerous cycle of excessive optimism and fear leads to poor decisions at the worst time.

Time, not timing, is the best way to capitalize on the stock market’s gains.

Take Advantage of Opportunities

Talk to your financial advisor to see if there are any opportunities during volatile market conditions. In a diversified portfolio, you may have a mix of large-cap, small-cap, foreign and domestic investments along with bonds and cash. The movement of the market could have changed the proportions of your holdings in each of these categories. You may want to rebalance to get back to your original investment strategy. This approach may also allow you to take advantage of lower prices during market turmoil.

Tags: Dow, Investing, Market Volatility, S&P